by Editor

Payment cards have always been an important and hard-to-access consumable in internet advertising. But everything is changing. And today's review is just about that. What it takes to get 100 cards at a pleasant price, what card management looks like, how these cards differ from others, what the top-up limits and fees are - all of this in our review of the Combo Cards service.

What the service offers: what BINs and types of cards are available, whether KYC is required

Let's start with the main thing! The service offers cards for both advertising payments and business expenses (for example, you can pay for subscriptions to services, hotels, plane tickets). There are nuances with the latter regarding MCC codes used for payment acceptance. But at least you can definitely pay for SPY services and antidetect with them.

The BINs are presented with a wide selection from 12 banking providers from trusted GEOs: the UK, Estonia, Hong Kong, and the USA. And judging by the updates on social media, the team is actively working to expand this list.

Next, when it comes to cards, it's important to note the availability of the following types of payments:

- Balance cards. These are cards where you can set up automatic reloading to avoid decline rates due to insufficient funds.

- Limit cards. These cards are linked to the overall balance of your account, and you can set limits on withdrawal amounts for them.

All cards come with 3DS. By the way, obtaining 3DS and OTP codes here is implemented through a Telegram bot. In the same bot, you activate your account (more on that below) and configure the necessary notifications for issued cards.

Next important detail: all NEW users of the service receive 20 cards for free and the opportunity to deposit up to $5000 without commissions within 2 weeks after registration.

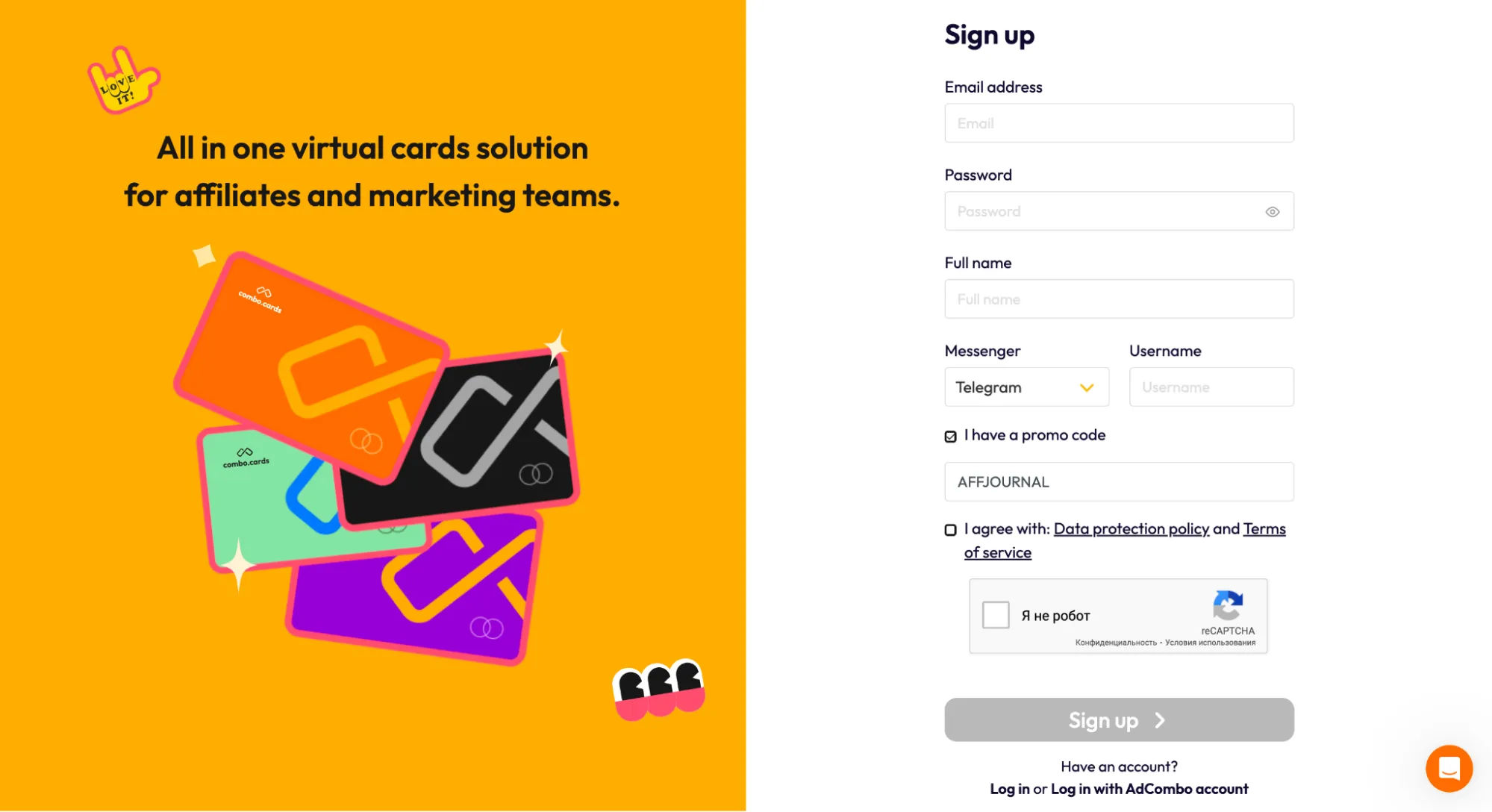

☝️ And by using the promo code AFFJOURNAL, you can get an additional 10 cards for free (the promo code can be activated during registration)!

Fees and tariffs at Combo Cards

It's important to note that issuance fees for cards within Combo Cards can vary significantly depending on the issuing bank. Why this is the case, surely, doesn't need explaining. Therefore, you may be able to get some cards for free, while for others, you'll have to pay from $1 to $3.

The minimum top-up amounts vary depending on the payment system you choose. For example, when topping up with USDT (TRC20 and ERC20), the minimum is just $1, with Wire it's $5000, and when topping up through the partner network, it's $50.

With that sorted out, let's talk about fees. Again, due to the variety of options and functionality available, there are many fees, but it all depends on your top-up methods:

- 3% if you top up your balance with USDT, Wire, or through the partner network;

- 3.5% for manual top-ups from an exchange wallet (Binance, Huobi, and others);

- up to $0.5 for a declined transaction, which can be refunded in cashback format;

- commission of up to $0.3 for successful deductions, depending on the banking provider;

- commission of $/€1 for withdrawing funds from the virtual card to the general account;

- commission ranging from $0 to $2.35 for card maintenance depending on the banking provider;

- commission for deductions in a currency other than the card currency ranges from 1% to 3% depending on the banking provider.

It's also worth mentioning declines because at the end of the month, depending on your methods of working with FB and Google, the fees for them can significantly impact your budget.

Declines, also known as chargebacks, are any unsuccessful attempt to debit money from a card. The reasons can vary, but the most popular ones include exceeding the limit and decline due to a frozen card. Each debit attempt generates 1 decline.

Why is this important? Because our service charges a fee for each decline, and its amount depends on how many declines you've had recently. This "how many" is determined by the decline rate — the percentage of declines out of all your transactions over the previous 7 days.

So, if today you had 100 transactions, and out of them 10 were declines, then your decline rate for today is 10%. If the decline rate is less than 3%, no fee is charged for declines.

It's enough to pay minimal but regular attention to your cards to keep the decline rate at a reasonable level! In case of debt, FB will regularly bill the card, expecting it to be activated at some point. Therefore, it's important to block cards that you no longer plan to use.

In Combo Cards, the fee for decline rates is as follows:

How to start using cards from Combo Cards

As for registration, it's worth emphasizing that the service gives users a choice - whether to undergo KYC or not. Those who’ve completed the identification procedure receive unlimited card issuance. And those who want to remain incognito will still be able to top up their account and issue cards, but with limitations:

- By topping up the balance with $50 or more, the user can issue 1 card. And use it for testing, for example.

- For topping up the balance of $500 or more, the user can issue an additional 10 cards.

- Every $5000 spent, the user earns an additional 5 free cards.

But in general, for 99% of webmasters in the market, there are no problems with passing KYC. Those who work with blatant blackhat use fundamentally different solutions. But it's worth mentioning :)

Took care of that, let's now go through the registration process and take a look at the personal account. Click on the link and fill out the simple form:

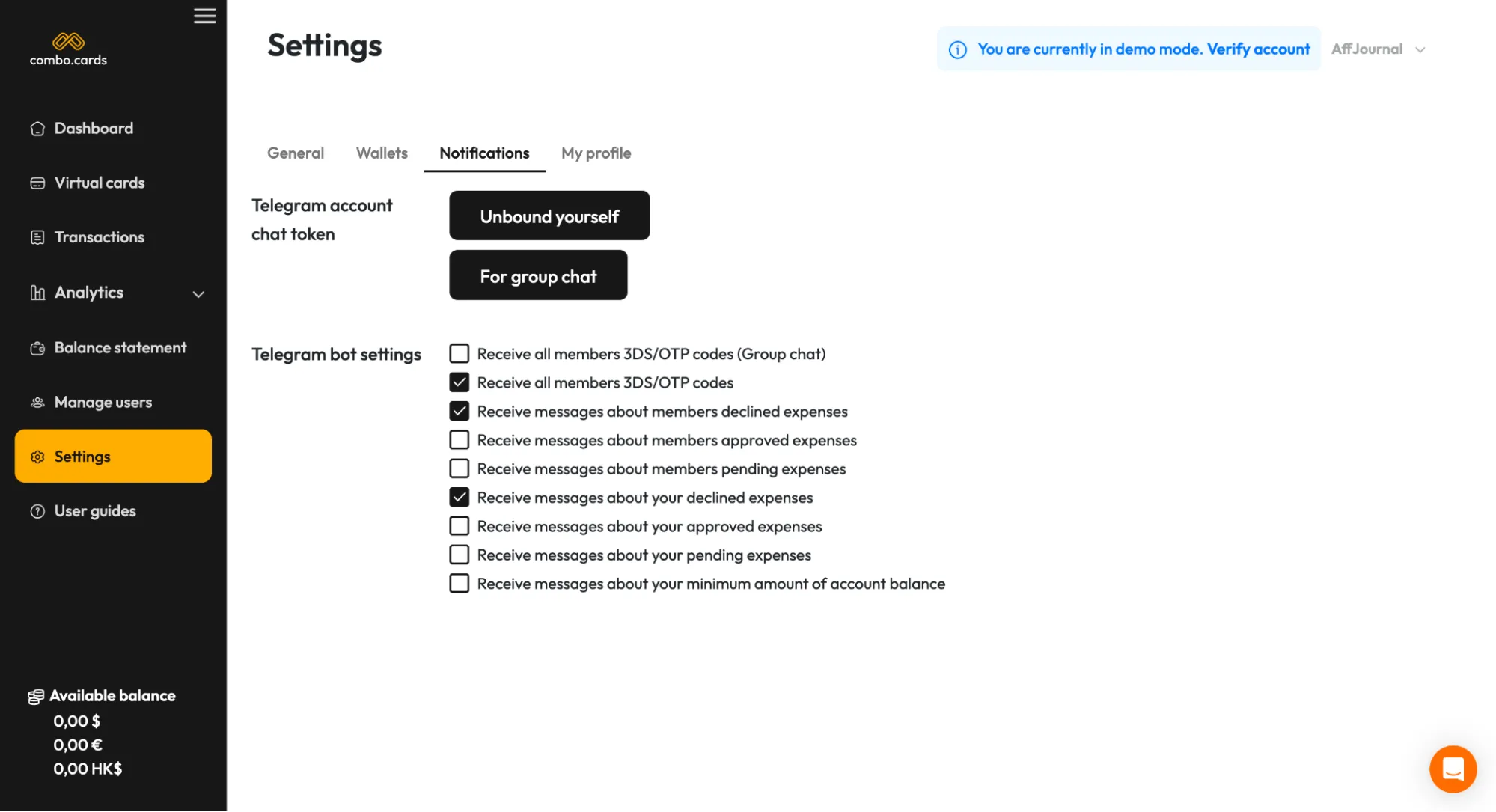

After email approval, we enter the personal account, where the service offers us to connect a Telegram bot to receive codes and notifications. Click on the token generation button.

Next, you need to choose which notifications you want to receive from the bot. For our convenience, we decided to stick with the following three points. Also, please note that if you registered on behalf of a team (more on that later), there is a switch for a group chat.

After that, we go to the bot and see that the account is already automatically linked.

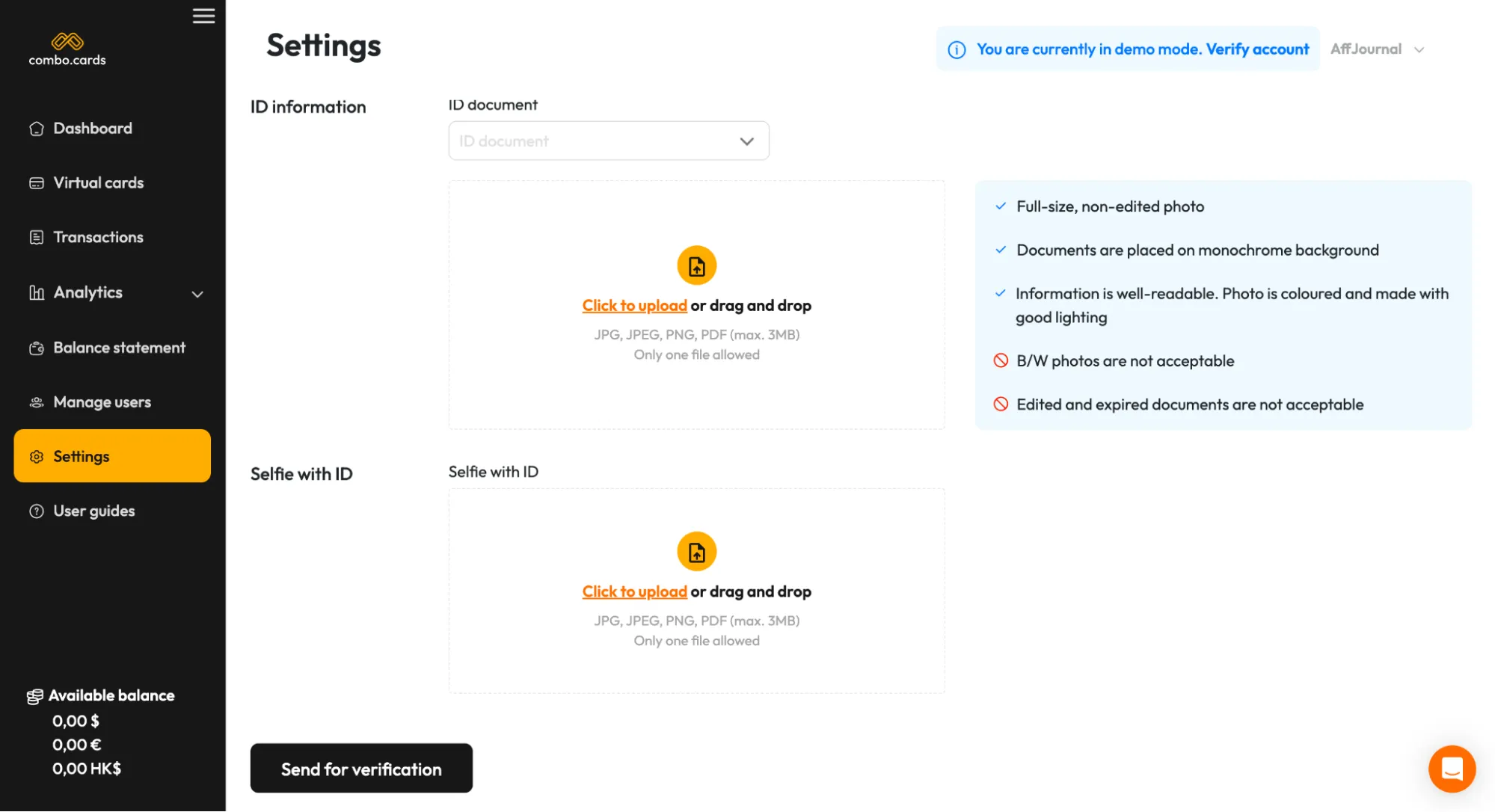

Next, as we can see, we have a banner indicating that we are in demo mode and need to verify our account. We click on it and see a form like this. We fill it out and wait for approval. Typically, the team processes incoming requests within 1-2 days.

If verification is urgent, contact customer support, but keep in mind that they operate from 10:00 to 21:00 GMT+3.

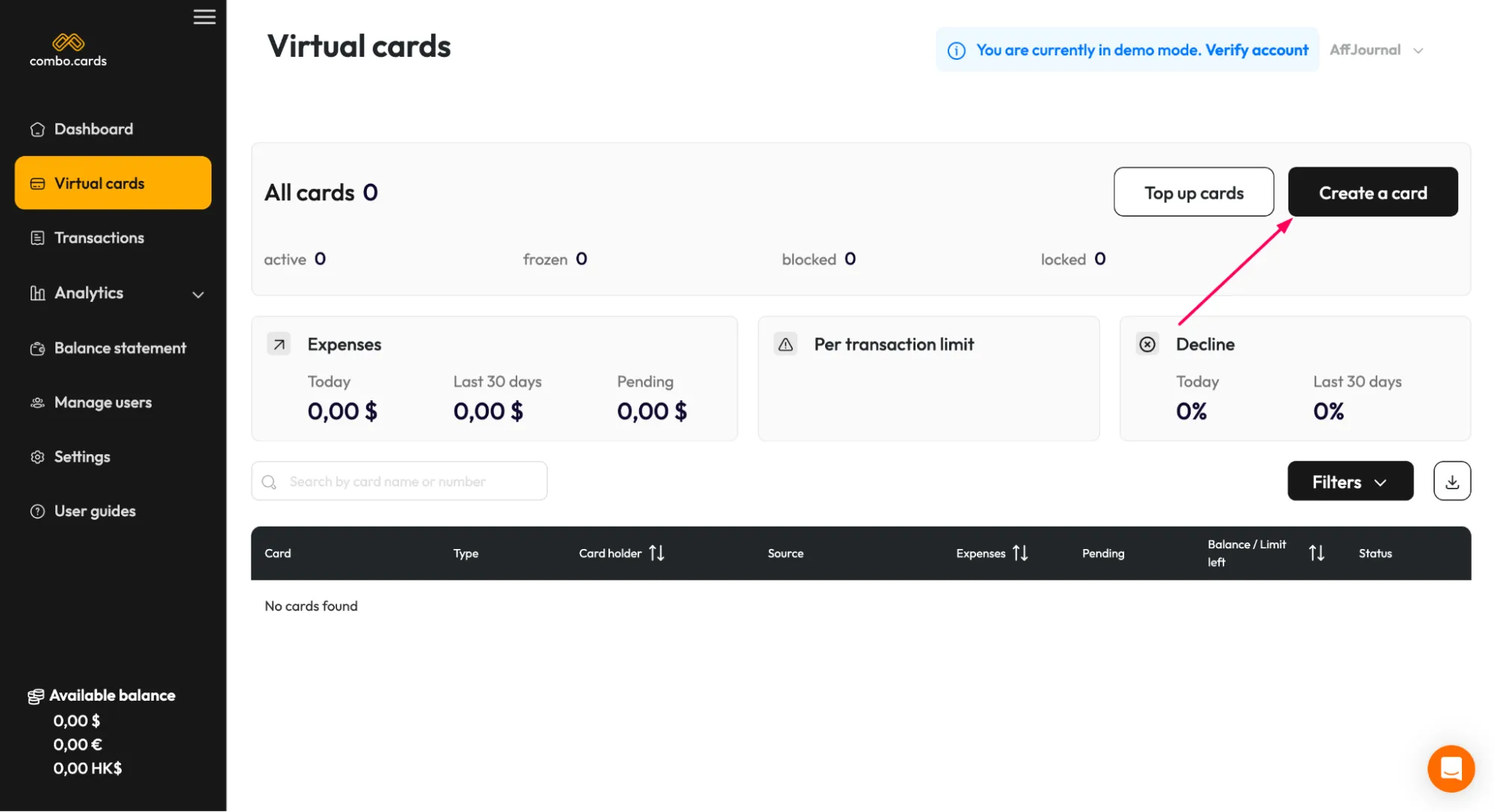

After your account is approved, you can issue 20 virtual cards without any restrictions. To do this, go to the "Virtual cards" section and click on "Create a card".

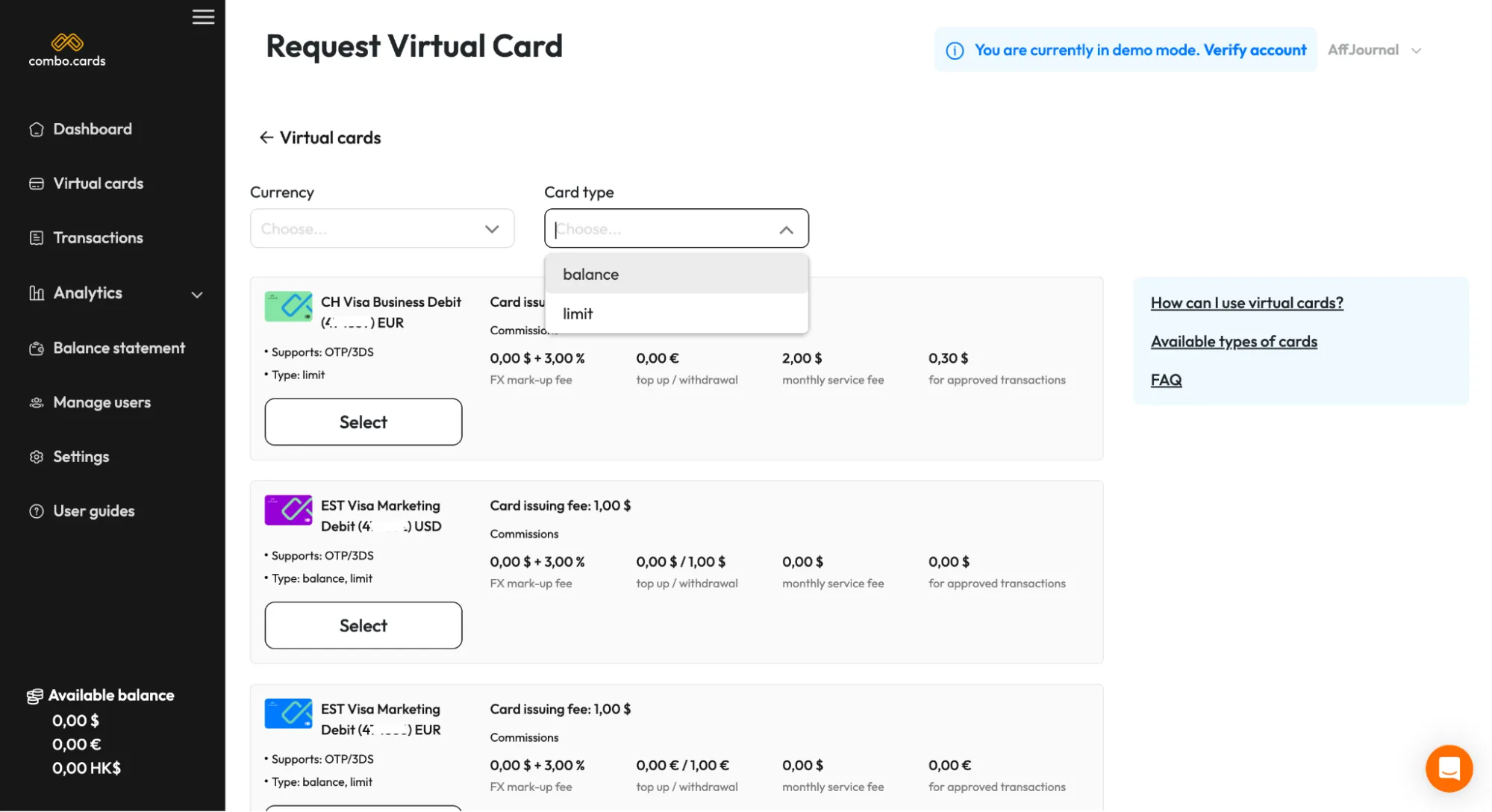

Next, you'll see a complete list of all the cards offered by the service, along with information about the cost of issuing a specific card and BINs. There is sorting by currency and card type (limit or balance).

To issue a card, click on "Select", set limits for the card, give it a name, and if you’ve already topped up your account, click on the "Request a virtual card" button.

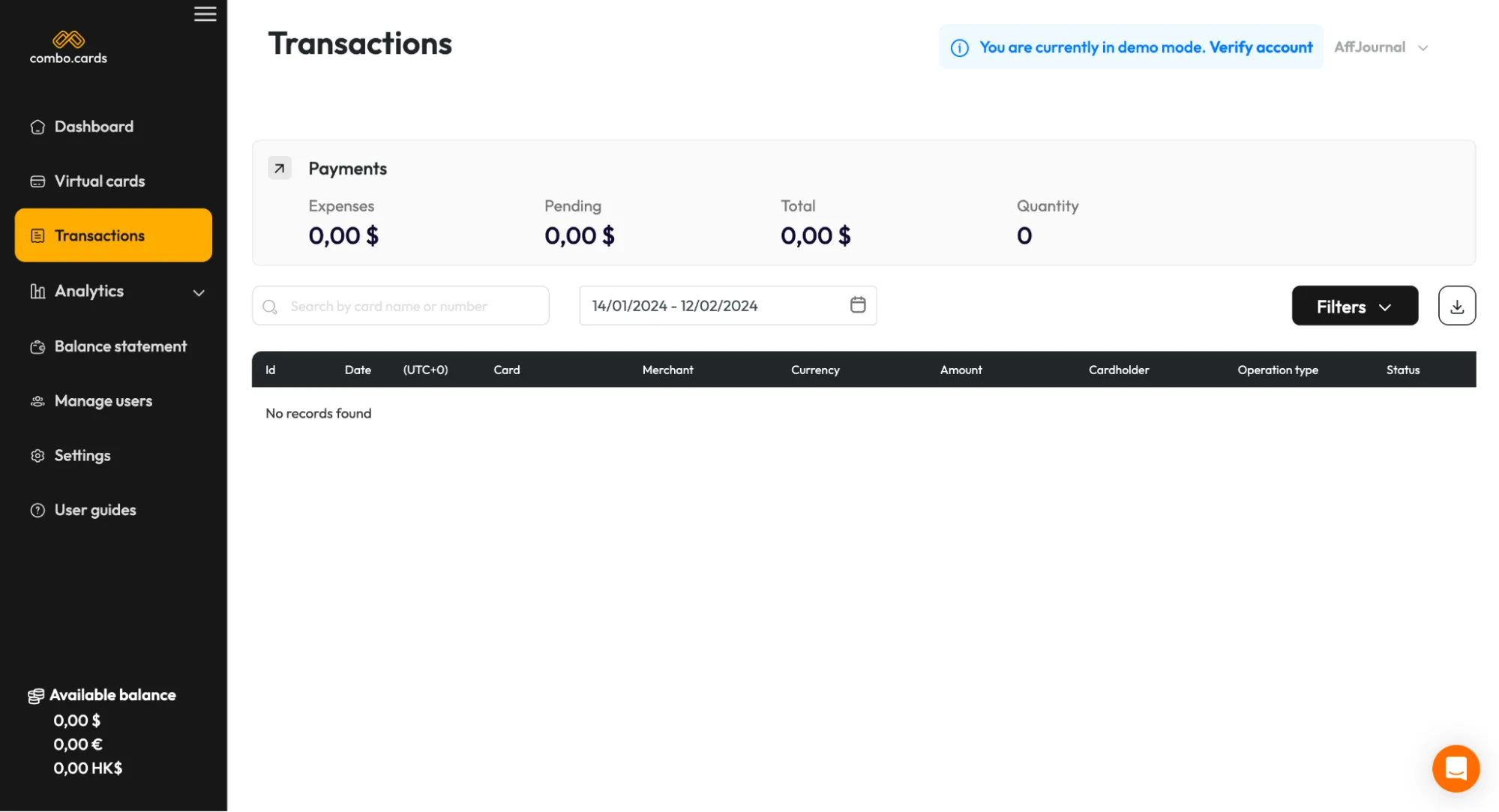

Transaction history, statuses, and holds for cards can be tracked in the corresponding tab.

Otherwise, we recommend taking a look at the "User guides" tab, where the team has created the most comprehensive FAQ possible.

What interesting features and advantages of the platform have we noted

You always need a lot of cards. Accounts on many sources get banned in batches every day (hello, FB!), so working with each card separately will take a lot of time, which is better spent on testing new combinations.

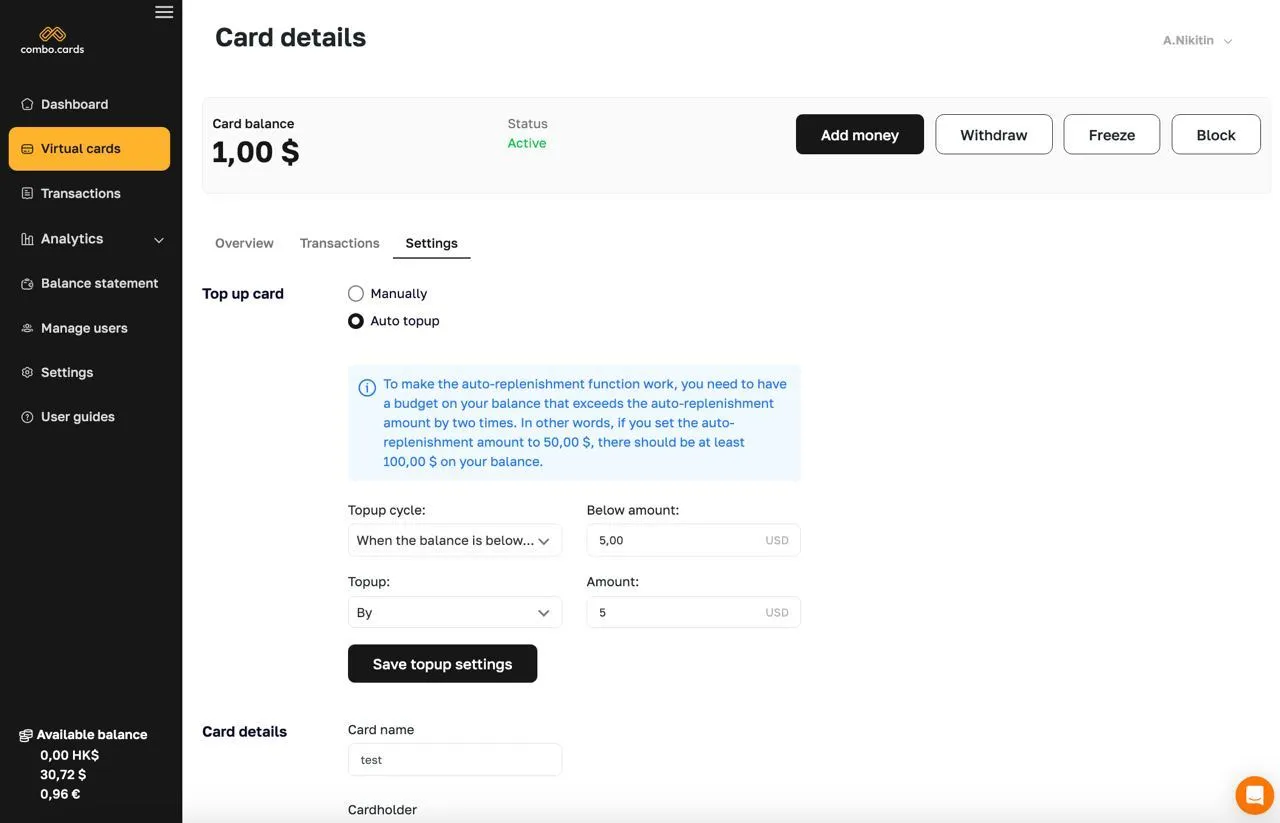

Therefore, the guys at Combo Cards have implemented mass auto-replenishment of cards. Here's how it works:

- Go to the "Virtual cards" section and click on the "Card details" button. Select "Settings" and in the "Add money" section, click on "Auto top up".

- Choose the replenishment cycle (for example, once a week, daily, or when reaching your desired limits), then select the currency and BIN. Note that bulk replenishment works for cards with the same BIN. If you have 10 cards with one BIN and 10 cards with another, you need to set up the configuration for each one separately.

- Press "Confirm".

Note that for the auto-replenishment feature to work, you need to have a budget on your balance that exceeds the auto-replenishment amount by two times. For instance, if you set the auto-replenishment amount to $50, you should have at least $100 on your balance. It's that simple!

It's also worth mentioning a few other interesting features:

- With Combo Cards, you can receive payments from affiliate networks, advertisers, and ad networks;

- You can rent credentials and accounts to work with developer accounts in Apple and Google Play app stores (given the current realities — a top feature).

- You can make bank transfers to counterparts worldwide (using the service, advertisers can pay salaries to employees, pay suppliers for services, replenish advertising networks/accounts).

☝️ Please note that these are pilot features, so for more details, it's better to contact support. In general, you can also read about all the innovations in the service's Telegram channel.

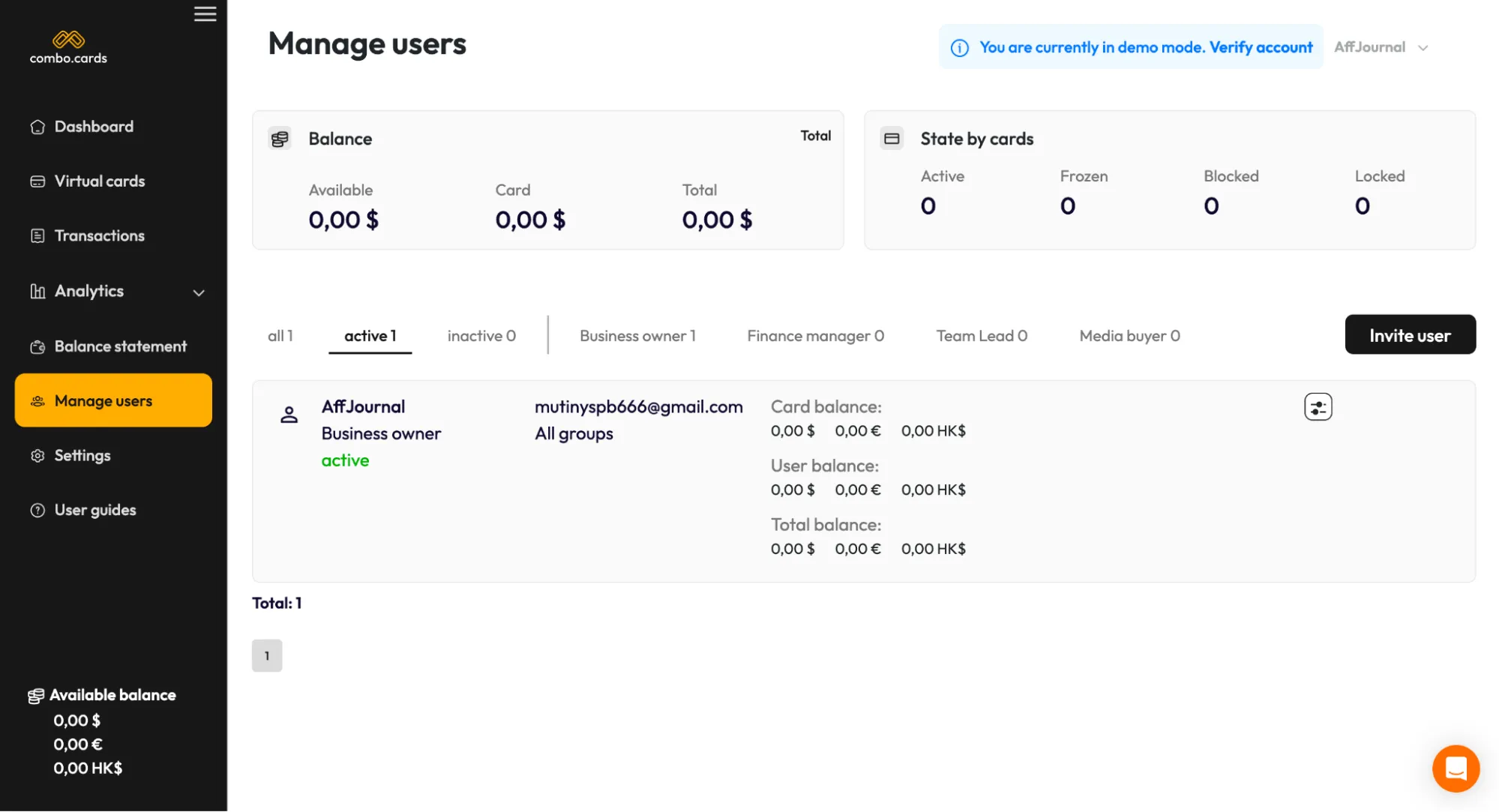

A few words about the team functionality in Combo Cards

Also inside the personal account, you can notice the functionality for team collaboration. Invite team leaders, financial managers, media buyers, set budgets, issue cards, view overall statistics, and individual statistics for each buyer.

In Combo Cards, there are several types of roles available:

- Business owner. Can perform any actions within the workspace, such as topping up the balance, creating cards, inviting new users and managing their access, viewing overall and individual statistics, etc.

- Team Lead. Has the same rights as the Business Owner, but only within their group.

- Finance manager. Can top up the balance, view all issued cards and transaction statistics, but doesn’t manage access for other users.

- Media Buyer. Can only perform actions on their own cards and view their own deduction statistics.

You can also differentiate between your own statistics and team statistics (the latter in a separate tab):

Summary aka editorial opinion

Cards currently play one of the main roles in an affiliate marketer's setup. There is an opinion that up to 70% of bans depend primarily on the card. That's why it's important to carefully choose the seller, as the payment method will affect everything else.

The guys from Combo Cards, firstly, understand this, and secondly, are working to provide the market with a wide choice and high trust. We personally were very pleased that the service is not afraid to confuse customers with a variety of options. Yes, it may take a little time to understand where each commission applies, but this is done primarily for the effective operation of the client. Register → carefully read the card terms → test different BINs → choose what works best for your setup, and you’ll be happy!

And don't forget that with the promo code AFFJOURNAL, you can get an additional 10 cards for free (the promo code can be activated during registration)!

Feedback on Combo Cards

It's probably also important to mention that the service has been around since 2022 and is already used by 3000+ affiliates. If you are one of them — welcome in the comments! We’d be glad to receive all the feedback. 🙌

by Editor

comments ....(0)

Leave a comment

You must be in to leave a comment