by Editor

The financial vertical in traffic arbitrage is one of the most stable areas with large volumes, high payouts and the ability to receive a predictable ROI from month to month. At Zeydoo we process tens of thousands of conversions for finance every month and are ready to share this expertise.

In this article: why it is profitable to direct traffic to financial offers, what difficulties await you and what you can lose money on, types of offers, traffic sources and recommendations for filling from our media buying. Let's look at the example of working offers.

Financial offers: advantages and difficulties

The financial vertical includes banks and payment systems that are willing to pay for opening new cards, deposits to accounts, bank loans, MFIs, insurance or a deposit to an investment account. A specific target action is set by the advertiser and written in the offer card.

What are the benefits of working with the financial vertical:

- often offers are presented by brands with a good reputation and a trusted history - these are trusted by the local audience, which contributes to an increase in CR;

- a wide target audience - often these are all adult users, which makes it possible to upload to a wide audience, reducing CPM and leaving the advertising campaign more space for scaling;

- a large selection of targeted actions - you can run in for issuing microloans, filling out questionnaires, collecting leads in the form on the site, issuing a card at a bank branch, or other actions specified by the advertiser;

- high payouts – depending on the target action, payouts can reach from $1 to $100 and more.

- white offers allow you to predict advertising budgets and payback, getting a stable ROI every month, especially if you upload good quality traffic for a budget.

Before testing financial offers, it is important to understand that this is a long-term job. That is, it will not be possible to quickly withdraw large amounts of profit here, since the margin is often no more than 20%.

However, the more the campaign is optimized or the cleaner your whitelist becomes in the ad network, the more money you get. If you take into account the absence of permanent bans and note that you set up once and then just spend up to 30 minutes daily on optimization, we can conclude that finances are a gold mine.

What difficulties can arise when dealing with financial offers:

- long hold - the average time for checking traffic is from 15 to 90 days, depending on the advertiser. Keep this in mind, especially if you have a limited budget for tests. Of course, after test flows, your hold may be reduced if the partner takes these risks and pays you before receiving money from the advertiser. To do this, you need to earn trust when working with the Affiliate Program and load more than one thousand dollars of quality traffic;

- when choosing an offer and launching a campaign, you need to carefully consider who your target audience is - for example, people taking a microloan are unlikely to convert on a landing page with a consumer loan, and those who are interested in insurance at a bank are unlikely to become interested in investments and deposits;

- the right accents in creatives and restrictions on the promotions used - well-known banks and large financial organizations often require control over which creatives an arbitrator uses, as they value their reputation. So, before each launch, it is necessary to coordinate the creative with the support of the Affiliate Program. In Zeydoo this takes a few minutes, but it is necessary to make sure that the advertiser pays the full amount for the traffic. Also, upon approval, we exclude misslead in creatives, which allows us to improve traffic quality and in the future receive bumps at base rates for a good and stable CR;

- a long way to a big profit, especially if you start with a small budget - this is due not only to a long hold, but also to a relatively low ROI, which increases gradually with campaign optimization and budget growth;

- restrictions on traffic sources - some offers have strict restrictions on specific sources, if you own only one of them, this can become a problem. We recommend studying at least 2-3 sources in order to squeeze out all possible bundles;

- people with bad credit history may be denied consumer loans, microloans and credit cards, so it is important to make the right accents in creatives and take into account that there may be a percentage of invalid leads.

Working with finance requires a thorough approach, detailed study of the target audience and patience. However, with due efforts, the investment and the time spent pay off dozens of times.

Types of offers

In the financial vertical, there are different categories of offers that are uploaded by CPA and CPL. We understand the main types of financial offers and the differences between them.

Bank cards (debit and credit)

An advertiser's credit or debit card is supposed to be opened. In such offers, the payment for the target action can go for:

- registration of the application on the site;

- opening a card at a bank branch;

- receipt of the card by mail and its activation;

- the first financial transaction made with the card.

Often, payments on credit cards are higher than on debit cards, since not all users fit into the credit limit, overdue payments and then pay the bank more money. Bank card offers have the biggest hold since it takes a lot of time for the advertiser to verify the lead.

What can you upload right now:

Microfinance organizations

Microfinance organizations(MFIs) – private companies offering fast loans for small amounts at high interest rates. Often the amount of microloans is no more than $10,000 and depends on the geo. Such offers are characterized by fast application processing. The user can get a microloan within 30 minutes.

Often MFIs give loans to people with low social status and bad credit history. Microcredits are issued at a high interest rate, but are still in high demand, since for some this money is the only chance to legally live up to a salary. Also, microcredit is popular for students and the elderly, and those who make impulsive purchases under the influence of emotions.

When uploing in for microloans, the payment usually goes for a correctly completed application on the site, or for an already received microloan.

What can you upload right now:

- MX - AmigoLoans - Direct

Investment accounts

The payout is paid to the arbitrator for the fact that the user opens a brokerage account in a particular bank, having passed verification and replenishing the balance. The exact conditions depend on the specific offers and advertisers. However, often some involve some of the most difficult flows for the user. The more steps a user has, the lower the conversion percentage. Therefore, carefully select offers and consult with managers about whether a particular offer will convert to your traffic source.

Mortgage, auto loans

One of the most difficult offers for the drive. Mortgages or car loans are often large loans that require a large down payment. So banks are demanding on such customers by checking their credit history. The conversion rate for them is low, but this is compensated by large payouts. The hold on such offers is increased, as banks spend more time checking the lead.

If you want to test the financial vertical, Zeydoo is ready to help you with a profitable start and give out converting offers with high rates. Register and your manager will help you decide on an offer for your traffic source.

Traffic sources

The most common traffic sources for the financial vertical are:

- Showcases - sites that aggregate a large number of offers from different banks or MFIs, helping the user to choose the best conditions for his situation;

- E-mail marketing - sending letters to databases is one of the most difficult channels, but with a potentially high ROI. The biggest difficulty lies in collecting the base and avoiding getting into spam. Databases must be collected only legally, in order to avoid fines for the advertiser and cut payments, since in some countries (for example, the United States) it is impossible to spam email, you can be sued for this;

- Contextual advertising - search advertising is one of the most "hot", as people are interested in cards, loans or microloans. The only limitation that applies to most offers is the context for brand queries;

- Targeted advertising - advertising in Meta, TikTok and other social networks. Often requires approval of creatives. Classic advertising, the launch of which is no different from the bay of other verticals;

- Teasers, push notifications are limited on many offers, but they are no less effective for those where they are allowed. In most cases, creative approval is required.

In offer cards in Zeydoo we provide recommended creatives for uploading: both banners and texts for push notifications or advertisements. Creative approval is fast, and managers select offers for your type of traffic for the highest CR and hassle-free payouts.

Traffic approaches

Our media buying works with two ways of uploading: via pre-lander and via mobile applications. It is funnels using these approaches that give us the opportunity to keep stable volumes.

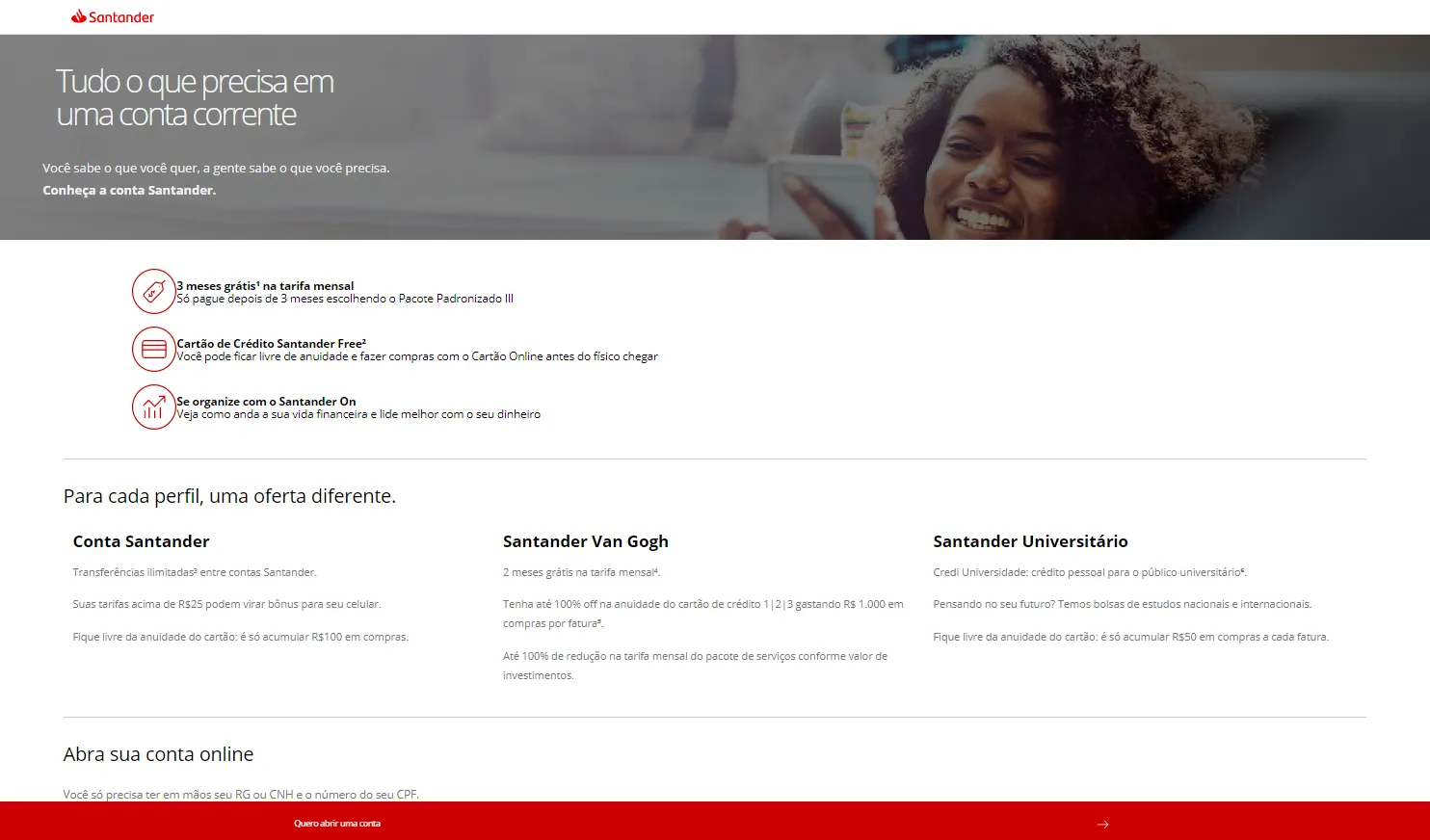

How to drive traffic through prelending

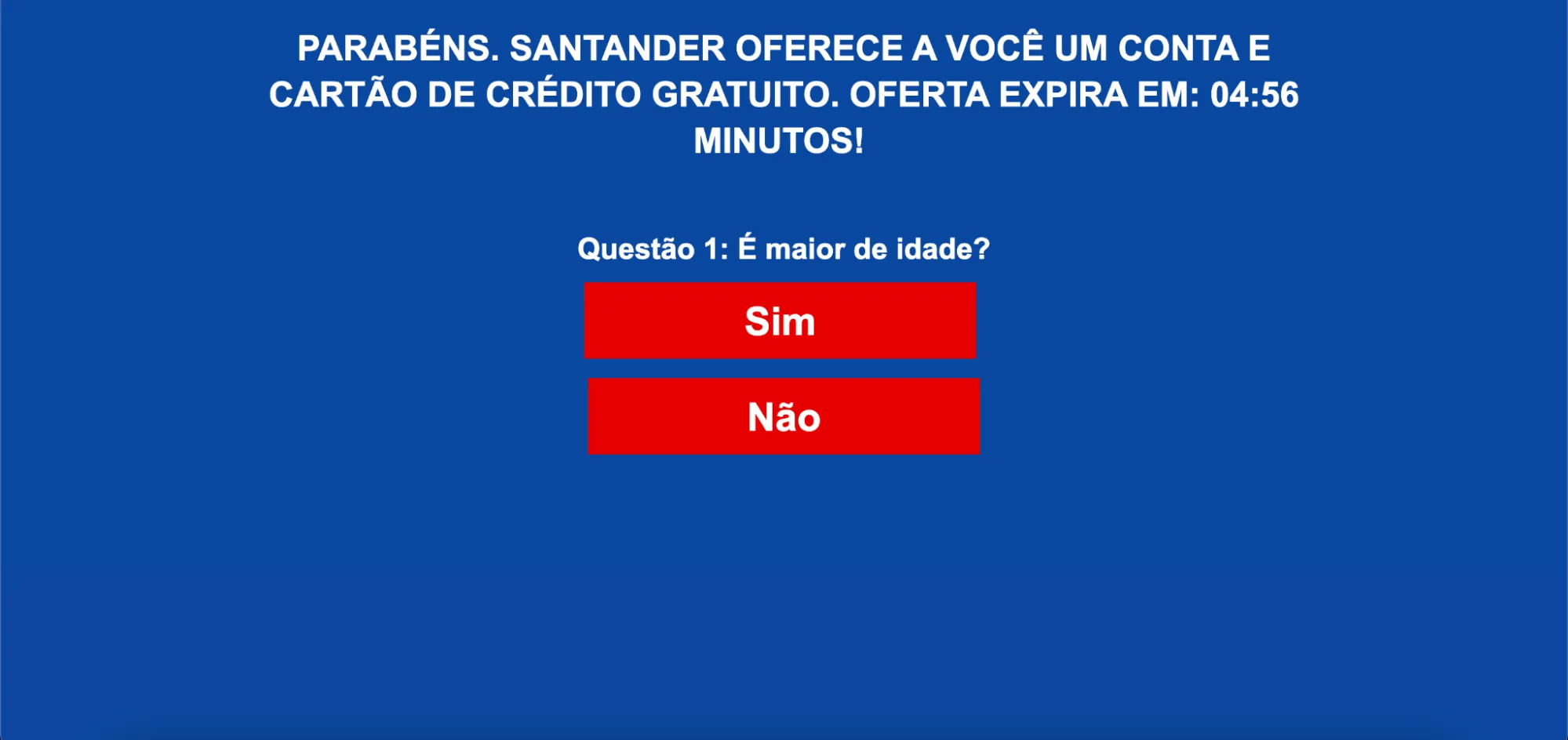

A great option to warm up the user and catch his attention is pre-landers in the form of questionnaires. Often they include 2-5 questions with “yes” or “no” or multiple choice answers.

If you transfer the user directly to the page with a card or lending, where you need to fill out a large form, the user can close the page without even starting to figure it out.

In the case of a pre-lander questionnaire, we immediately involve the user. In this case, the landing page also has a time limit of 5 minutes and after 3 short questions, the user is told “Your application has been approved, all that remains is to fill out the form.” That is, a person already understands that he received the money, all that remains is to enter the data and pick it up - this increases the conversion.

An example of a pre-lander for financial offers

You can download this preland from the link. And you can get the most delicious Santander rates from your manager.

Upload through apps

With such a funnel, the download goes to a mobile application on Google Play. The flow is familiar and simple for the user:

- Go to ad

- Install the app from the store.

- We open it, register and take a microcredit in no time.

This method converts well, as users trust applications in the store more than ordinary advertising. Also, if the conversion did not happen immediately after installation, the user can be pressed by push and he will convert, and you will receive a payout.

Mobile Application Example Quick Empréstimos rápidos.

Zeydoo media buying recommendations

A few questions that will help make your traffic more profitable. Zeydoo media buyers answer.

What is more profitable when running from Facebook: working with pre-landers or apps?

We get more CR and, accordingly, profit by uploading to pre-landers. The user does not need to download anything, so the conversion is higher.

Which traffic source gives the highest quality to the advertiser?

The hottest traffic with the best quality is PPC. This is explained quite simply, because the user comes to the search engine to look for information about a loan or a card, that is, he is most interested in this.

Is it possible to work with traffic from TikTok, YouTube Shorts, Reels with Free Trial? Are there any such cases? If so, how does the quality of traffic differ from paid traffic?

You can generate conditionally free traffic, but we only work with paid traffic. Scrolling through TikTok, sometimes I came across financial offers that are poured shareware, so someone is definitely doing this. However, we cannot judge the quality of such traffic, since we do not work with it. Test and be happy.

Burn at least one chip that can increase CR when uploading in finances?

In promo-materials use popular people GEO and be sure to promise some kind of bonus. For example: free service (if we are talking about issuing a card) or 100% guarantee of a loan (if a Microfinance Organization).

What is the average ROI you get? What are the traffic sources?

On average, from paid traffic we keep ROI at the level of 60%.

What financial trends do you expect in 2023? How to influence the growth of payback with rising traffic?

Traffic is getting more expensive, and in some cases rates are even lowered. So you need to look for ways to monetize. If you are working through the application, then this is pushing users with other offers. If these are pre-landers, use a push subscription as a domonetization.

So, working with financial traffic is all about long-term work and the willingness to optimize campaigns at a distance, increasing ROI. Campaigns require tight creative controls and good traffic quality so that the advertiser does not reject the payout

by Editor

comments ....(0)

Leave a comment

You must be in to leave a comment