by Editor

Today, together with you, we’ll analyze the traffic from one of the webmaster's flows, examine specific figures on the traffic data that I can publicly review, and as an advertiser, draw conclusions within the framework of the campaign. This will be interesting because right before your eyes, I’ll be manipulating the traffic evaluation in the admin panel, and from the collected data, creating an overall picture of the traffic, as well as graphs that will allow us to answer the questions:

- Is this traffic suitable for us?

- How much are we willing to pay for it?

- How long are we willing to buy it out for?

- Can it be improved?

For this article, I’ve prepared a partner's campaign for the period from 03.07 to 09.07 so that we can examine this traffic after one/two/three/four weeks of its life on the product.

We obtained 1096 FTDs, and we’ll analyze them based on the following characteristics:

- Click2reg;

- Reg2FD;

- Click2FD;

- AVG FD;

- Repeat rate (RD, %);

- AVG RD;

- FD SUMM;

- RD SUMM;

- BET SUMM;

- Total NGR.

On the product, these metrics are considered primary to determine the quality of traffic. So, let's gradually study the data. It's important to note: the statistics are displayed in dollars. The campaign essentially starts on 3/07, and on this day, the traffic shows the following figures:

Click2reg

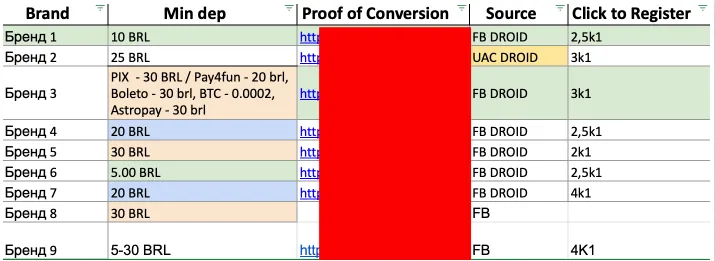

Received 16086 clicks, out of which 5960 registrations were obtained. The conversion rate was 1 to 2.69. Excellent. This is the average conversion rate in the Brazilian market, ranging from 1 to 2.5-4 from click to registration (we’ll show a screenshot of the market's top performers).

Such a metric indicates that the webmaster's creative/advertisement text and call to action create high engagement and immediately suggest that the traffic is targeted.

Of course, in the case of misleading creatives with exaggerated promises in advertisements, such a conversion to registration is widespread, and typical for such traffic would be a weak conversion to deposit.

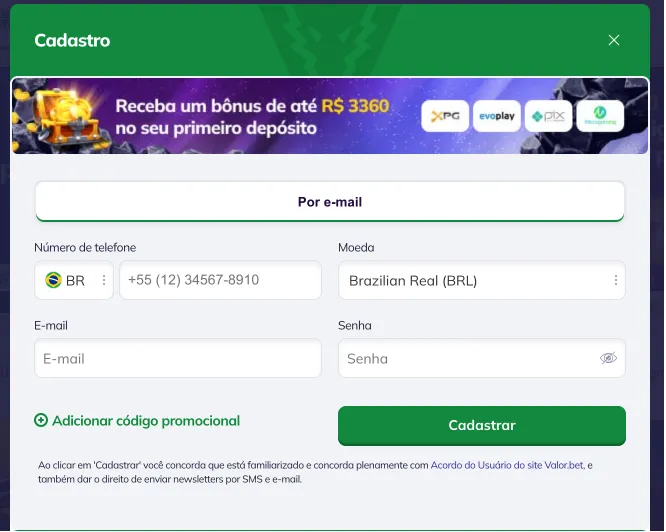

I'll add the fact that such a conversion to registration is achieved even when collecting a mobile phone number. I mention this so you understand that the registration time on Valor differs from most regular forms, where only an email and password are required.

On the screen, you can see what the registration form looks like:

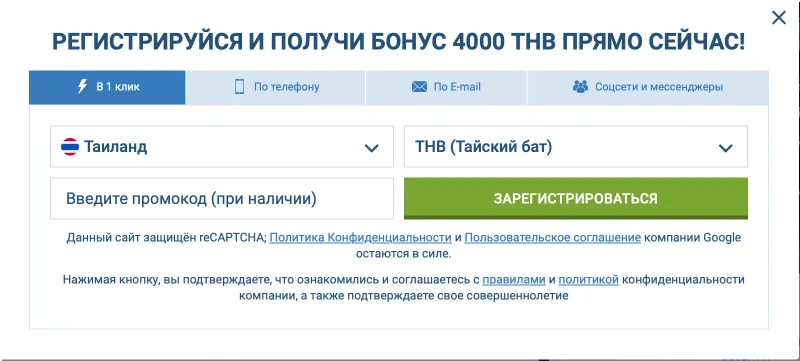

And on desktop:

We collect email, password, as well as mobile number. So even with a longer registration process and the collection of such type of data (phone number), which many brands hesitate to take at the initial stages due to the potential loss of players at this stage (entering an 11-digit phone number takes an additional +3-5 seconds), the webmaster's traffic conversion to registration is good.

How to influence?

Primary influence comes from the quality of the advertising creative and its message — emotions/winning/a specific expected bonus that is available on the product (but about creatives in future videos), truthful creatives with the formation of what awaits the player. Then, upon landing on the product, the player should understand the registration process clearly + it's necessary to continue exactly and quickly with what was in the advertising creative. As for us — the web promotes with the indication of the bonus, — we indicate this bonus in the registration form. So, the chain continues.

Significantly better conversion with as little data as possible required in the registration form, but it's important that the amount of data required is just enough to register only engaged players who need it, while excluding passersby. What determines the number of fields in the registration form? It depends on the jurisdiction of the country where the traffic is coming from and the product's strategy. By jurisdiction, I mean many brands are required by licensing rules to collect the first name, last name, middle name, gender, age, shoe size directly in the registration form. These are their rules. Although some data could be omitted, they simply don't know.

Now, what I mean by strategy. For example, when a brand decides to simplify registration for its potential users to one click. At one time, Xbet's decision to convert a user in one click made a splash. The flow looked like this: The player lands on the product — then they see several available registration methods (via email, phone, through social networks) — and the priority is given to one-click registration, where their country and currency are already filled in, determined by the IP of their device, and all the have to do is click the registration button — then the system offers to send the password and login to the user's email or save it to a file (to log in with this data later).

Why is this dangerous when you're working on a CPA basis, for example?

Because this creates a high chance that the user will duplicate accounts due to: not saving the login/password initially — forgetting where exactly saved it — logging in from another device and still deciding to register quickly.

And thus, what does this entail for the advertiser — the player may create accounts left and right. And yes, they may show activity on another account, but overall — their LTV will be diluted and there is a high chance that they will eventually forget the data for the account where they have cash left. They’ll have a bad user experience and won’t return. What does this entail for the webmaster — their traffic may create duplicate accounts for itself, these accounts will be marked as fraud. Moreover, real players who converted well initially — may simply switch to a duplicate account, and the advertiser will have questions for the webmaster about activity, like why out of 50 users brought, only 3 are active. But not mentioning that 25 of them made a duplicate account and are playing side by side. In general, in the case of traffic arbitrage and purchasing this traffic in volumes on CPA, these are risks of headaches and incorrect traffic assessment. I myself know the answer, why Xbet and its big clones kept the one-click registration option. But do you know? Write your options in the comments, it's very interesting. For those who are closer to the truth, I have a checklist of non-obvious questions that will help you find pitfalls in working with an advertiser.

Reg2FD

The conversion rate to the first deposit on the product — we see 5960 registrations and 1096 FDs, totaling 1 to 5.4, which overall from registration to deposit = higher than the market by 20-30%. This is also a plus. And the main thing, in the context of our brand, it doesn't exceed the norm. We check it off and move on.

Click2FD

Out of the users who visited the site, how many made a deposit — we see 16086 clicks and 1096 first deposits, hence the conversion rate from click to registration is 1 to 14.6, which means practically every 15th user who first visited the product made their first deposit — meanwhile, the average click2FD ratio in Brazil ranges from 1 to 25 to 1 to 30. At least, I studied the top 5 products in BR and can confidently say this. Undoubtedly, within the scope of my analysis and with the data available to me. Okay, we’re within the norm. Let's move on.

AVG FD

The average first deposit — the first indicator that begins to shape the advertiser's understanding of the monetary potential of players. In conditions of a certain minimum deposit on the product, the higher the difference between the minimum deposit and the average first deposit, in favor of the deposit = the better and more lucrative the audience. For example, when the minimum deposit is $5 and the average first deposit is $15, we can confidently state that:

- The traffic is engaged and financially capable.

- The deposit flow is working excellently, and the mechanics allow us to achieve a first deposit rate higher than the minimum.

- Players are interested in the size of bonuses, and to obtain them, they make deposits that exceed the minimum requirement.

In our example, the average deposit across the entire flow amounted to $9.03, which translates to approximately 50 BRL. Taking into account the fact that the minimum deposit that can be made on Valor is 25 BRL, we find that the average first deposit is twice the minimum deposit. This further strengthens our previous conclusions.

Repeat rate (RD, %)

The repeat deposit rate metric reflects whether the brand has succeeded in retaining the player after the initial engagement, whether it has piqued their interest, and whether it has met their expectations for the game. No player will make a deposit twice or more if the aftertaste after the first loss of money remains negative. It's crucial for the player to ensure that the product is good, that playing here is feasible, and there are numerous behavioral factors that make the player fall in love with the brand, compelling them to make repeat deposits and receive both emotional satisfaction and the offered perks and bonuses from the product.

Here, I'll make a note that there are two different ways to analyze repeat deposits: the unique repeat rate (uRR) and the overall repeat rate (RR).

uRD stands for the metric calculated on unique users, where deposits are counted from individual unique users. For example, if there were 100 FDs and 100 repeat deposits, but they were made by only 50 players, the uRD in this case would be 50%. The second metric, RD, which is usually displayed in stats, calculates the repeat rate percentage based on the total number of repeat deposits. For instance, if there were 100 FDs and 100 RDs, the repeat rate percentage in this case would be 100%.

In our current calculations, we use the total RD metric. In more in-depth analysis, it's important to consider both calculations in analytics. So, on July 3rd, the metric stood at 17 repeat deposits out of 38 first deposits, which equals 44%. This rate is not anomalous and falls within acceptable limits, staying within the norm for the product. Let's move on.

AVG RD

The average size of a repeat deposit confirms interest in money. Obviously, the higher it is, the better. On July 3rd, the indicator was $9.7, which is 1.8 times higher than the minimum acceptable deposit on the product.

FD SUMM

The sum of the first deposits. Once the average first deposit is known, it's not difficult to understand the picture within the framework of the initial amounts deposited by players. Nevertheless, let's take a look. On July 3rd, the sum of the first deposits amounted to $417.7.

RD SUMM

Immediately following, RD was $166.16.

BET SUMM

The sum of bets reflects gaming activity and allows us to assess gaming potential. The lower this indicator, the less active the players are, potentially less interested, hesitant to risk balances, playing cautiously and meticulously, which again slows them down from playing more expansively, which is, of course, bad for the product.

On the first day, players wagered $10307.66, which is an excellent figure for 38 attracted players on the first day of the campaign. The indicator is good, not anomalous, and in high reference values, which once again confirms the quality of the acquired traffic. Let's move on. This indicator is often used as a KPI, for example, for traffic payment to the Pinup brand for two weeks, the ratio of the sum of bets to the sum of deposits.

Total NGR

The indicator reflects the net profit from players, after deducting all commissions. It allows us to see the net profitability from players and can be used to calculate the return on investment for the traffic, knowing our expenses. Of course, evaluating such a metric on the first day of the campaign is not rational; it’s important to assess it over periods, and its growth will indicate that players are leaving money in the casino.

Let's look at all the days in the period from 03/07 to 09/07. We’ll see that the volume of traffic for the first deposits increased, as did all its indicators.

Thus, the overall stats are as follows:

- Total FDs = 1096

- Click2reg = 1 to 2.6

- Reg2FD = 1 to 5.4

- Click2FD = 1 to 14.6

- AVG FD = $9.03

- Repeat rate (RD, %) = reached 92.59% in the first week

- AVG RD = reached $16.26 in the first week

- FD SUMM = $9896.06

- RD SUMM = $16709.23

- BET SUMM = $264127.21

- Total NGR = $11149.79

Based on these figures, we can calculate our return on investment, assuming that each player cost us, for example, $15.

From here, the formula is as follows:

Return on Investment = (Net Income - Total Expenses) / Total Expenses

In this case:

— Net Income is $11 149.79 (our NGR)

— Total Expenses are calculated as the product of the number of players (1096) and the cost per player ($15), which amounts to $16 440.

Substituting these values into the formula, we get:

Return on Investment = (11149.79$ - 16440$) / 16440$ ≈ −0.32 * 100% = −32.17%

This is an excellent indicator, as already in the first week of the campaign, the webmaster has recouped 67.82% of their investments + considering the growth of the repeat rate, as well as the total bet amount, we see all the prospects that the traffic will pay off in the next 2 and 3 weeks (which it did).

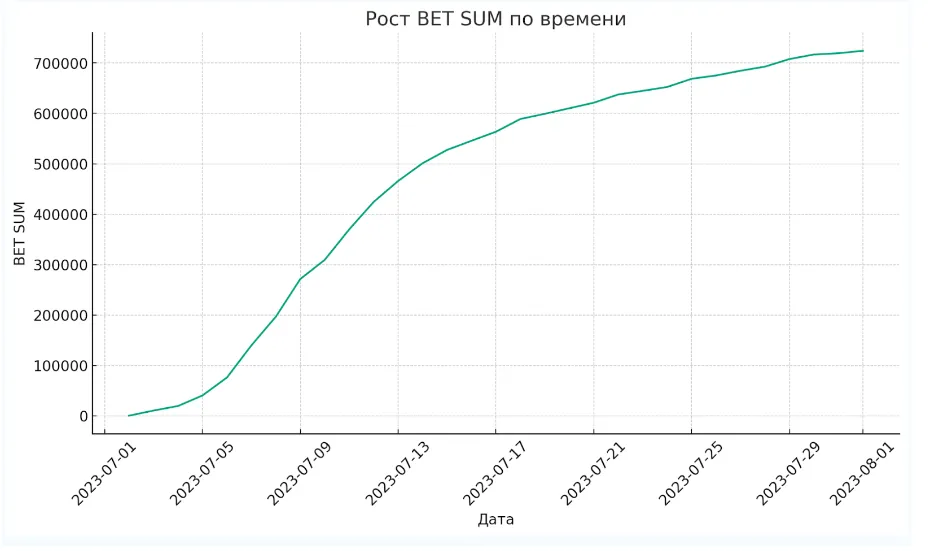

Next, let's look at the campaign from 03/07 to 31/07 inclusive, and in the format of graphs, see how the campaign has changed:

By 31/07, the total number of first deposits from the early 1096 FDs increased to 1218 FDs (meaning there were additional deposits), and the number of repeat deposits reached 3080, resulting in a repeat rate of 255%!

This graph shows us the increase in the number of DEP (repeat deposits) — the growth is smooth, indicating the organic nature and “integrity” of the traffic. There are no significant drops or gaps, which confirms the following:

- Payment activity on the product was stable, and payment solutions worked as expected.

- The product has a positive impact on players.

Next, the graph of the deposit amount (both initial and repeat deposits) also shows a smooth growth, and by 31/07, the total amount deposited by 1218 players reached $58 277.42.

Below, looking at the graph of the growth of BET SUM, we can see that the total amount of bets as of July 31st inclusive amounted to $718 761.62.

Further, the graph of the NGR growth, which largely determines the subsequent traffic acquisition. NGR as of July 31st, two weeks after receiving the traffic, amounted to $23979.51, generating a revenue per player of $21.4, calculated as $23547.9 / 1,096. This is what users who arrived at the product in the week from July 3rd to 7th brought in after two weeks.

What does this tell us? That the traffic, purchased at $15 per first deposit, has successfully paid off. According to our agreement, the webmaster receives 50% of the profit for life after reaching profitability.

Today, our task was to understand some important metrics and answer the questions that determine whether to acquire such traffic or not.

We delved into the numbers just enough to draw the following conclusions:

- We are ready to acquire this traffic.

- For this traffic, we’re willing to offer a 100% revshare until it’s profitable, and afterward, split it 50/50 with the partner.

- We’re willing to buy it out as long as it maintains this quality or even improves.

- It can always be improved through funnel optimization, but that's a topic for another video on the channel.

You've been with Danil Fokin, CEO of the Valor.Partners affiliate program. Don't forget to like and subscribe to our social media channels, where you'll find even more interesting content.

by Editor

comments ....(0)

Leave a comment

You must be in to leave a comment