by Editor

How does an affiliate network understand if your traffic is of high quality and you should raise your cap or increase your bid? The folks from BROFIST.partners, using the example of the gambling vertical (one of the most challenging in terms of traffic analysis), share their analysis of the traffic from two of their partners. It turned into a small reality show, so grab your chips and cola - it's time to start, let's go!

Input data

To ensure the analysis is conducted objectively, it's important to establish the initial conditions of the partners' work. We have two teams as partners - “7-x” and “8-x”:

- They divert all traffic to their own application;

- They use push notifications for the traffic they're diverting;

- They are driving traffic to our product for the first time;

- They plan to target Switzerland with a rate of 250 EUR and a baseline of 25 EUR;

- They state that they have been working with Switzerland for a long time, and everything has always been paid.

Week 1:

In the first week, we expect activity, meeting the offer's conditions (geo, baseline, the deposited amount).

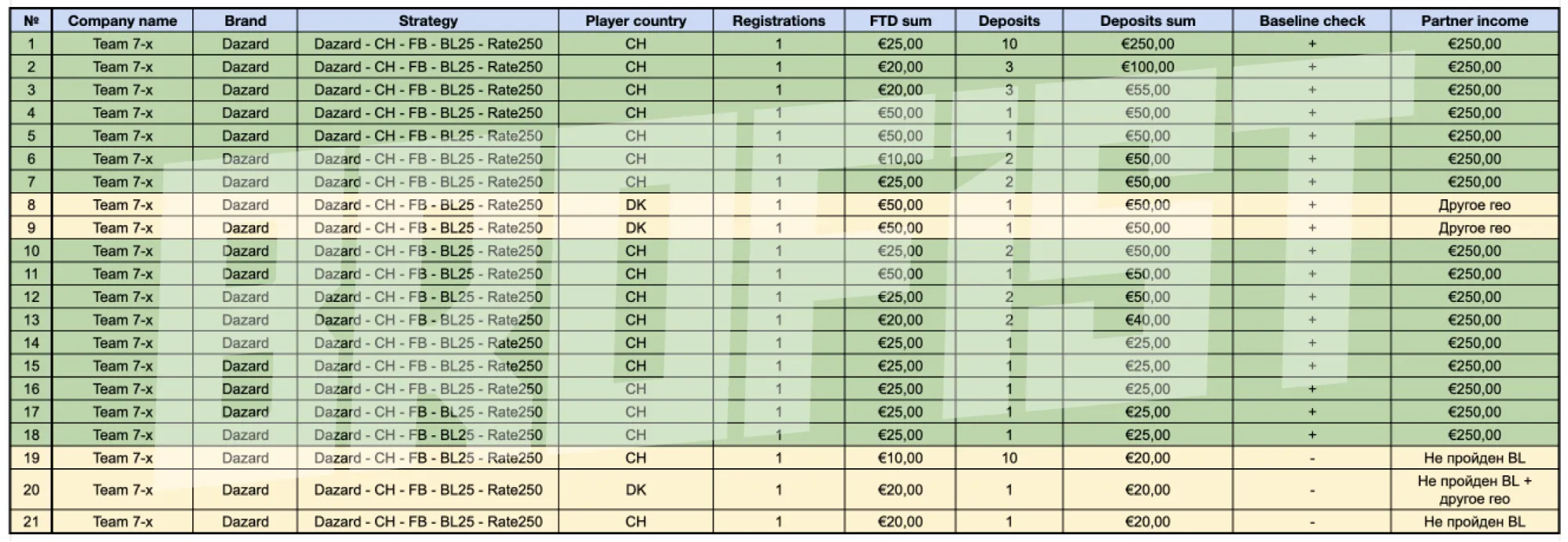

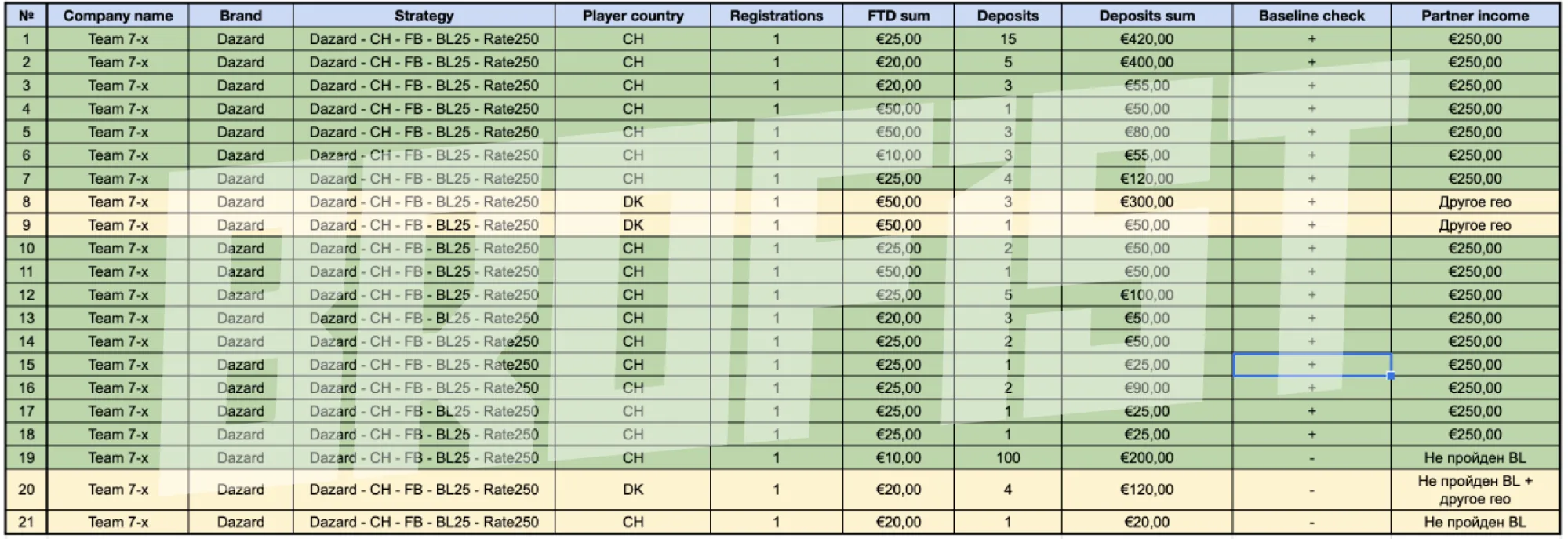

What we see at the moment with “7-x”:

- Total of 21 FTD are generated;

- Among them, 3 FTD are not from that GEO (but, by the way, any reasonable advertiser will consider them for post-payment if all traffic is good. Either under different terms or through RevShare. If you are a god of negotiations, you can even get paid up to 250 EUR within this deal);

- 2 players from the target GEO didn't pass the baseline (but that's for now);

- 10 players have only made 1 deposit;

- In total, the players have deposited 1080 EUR on the product;

- Green players have deposited 920 EUR;

- And we plan to pay the partner 4000 EUR;

- Traffic profitability is 27%.

This intermediate result for the first week is considered highly interesting and more than adequate, especially for Facebook. We see that in the deal with the Baseline, we’re interested in acquiring more traffic from this partner, which we’ll do. By the way, the traffic profitability for the advertiser is far from 27% since it doesn't account for bonuses, provider commissions, payments, and so on. But even looking at this indicator, we can conclude that we’ll continue purchasing traffic.

It's important to understand that we aren’t focused on our own profitability. We’re looking at the traffic activity, the amounts of deposits made, as well as the amounts of those who don’t meet the conditions but in exceptional cases.

In addition to these basic metrics, we’re, of course, interested in player behavior: which cards they use, whether there is fraud, and so on. But usually, it's quite challenging to detect such things at this stage, so we’ll perform checks on these parameters a bit later.

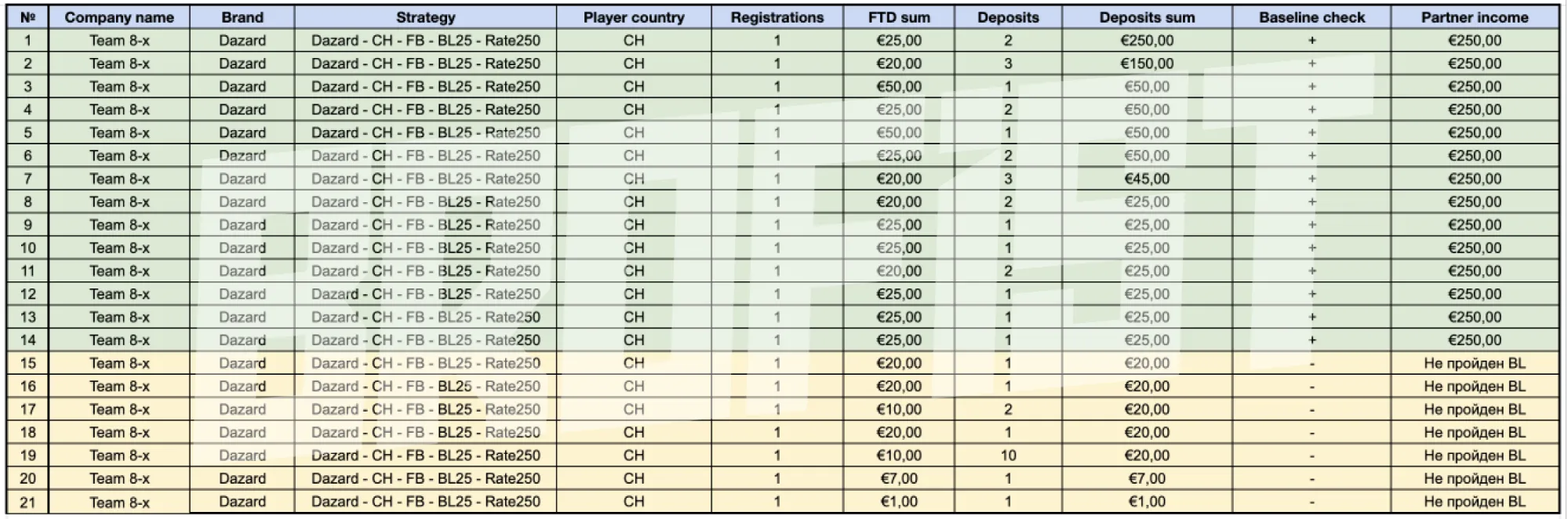

Now let's see how the team 8-x is doing:

- Total of 21 FTD are generated;

- 7 of them didn’t pass the baseline;

- 7 players have only made 1 deposit;

- In total, the players have deposited 928 EUR on the product;

- Green players have deposited 820 EUR;

- We plan to pay the partner 3500 EUR;

- Profitability is 26,51%.

I anticipate three types of people at the screens right now:

- Nothing’s clear;

- All clear;

- Eager for more.

Now, let's discuss everything and draw conclusions.

For starters, it's worth mentioning that at this stage, as advertisers, we should make only one decision: whether to buy overcap or not?! We’ll do this based on the numbers and metrics we already have, which we’ll analyze below.

We need to understand if we are completely satisfied with the activity that has already come. If yes, we provide a new budget and that's it. If it's satisfactory but could be improved, we provide input data and also extend the budget. It's evident at first glance, for example, that the team 8-x has many players with only one deposit. It can definitely be improved, despite the fact that not much time has passed.

When making a decision about overcap, as advertisers, we mostly commit to paying for the traffic that has already been acquired. Therefore, to do everything correctly, we need to make the decision as calmly and consciously as possible.

Comparison

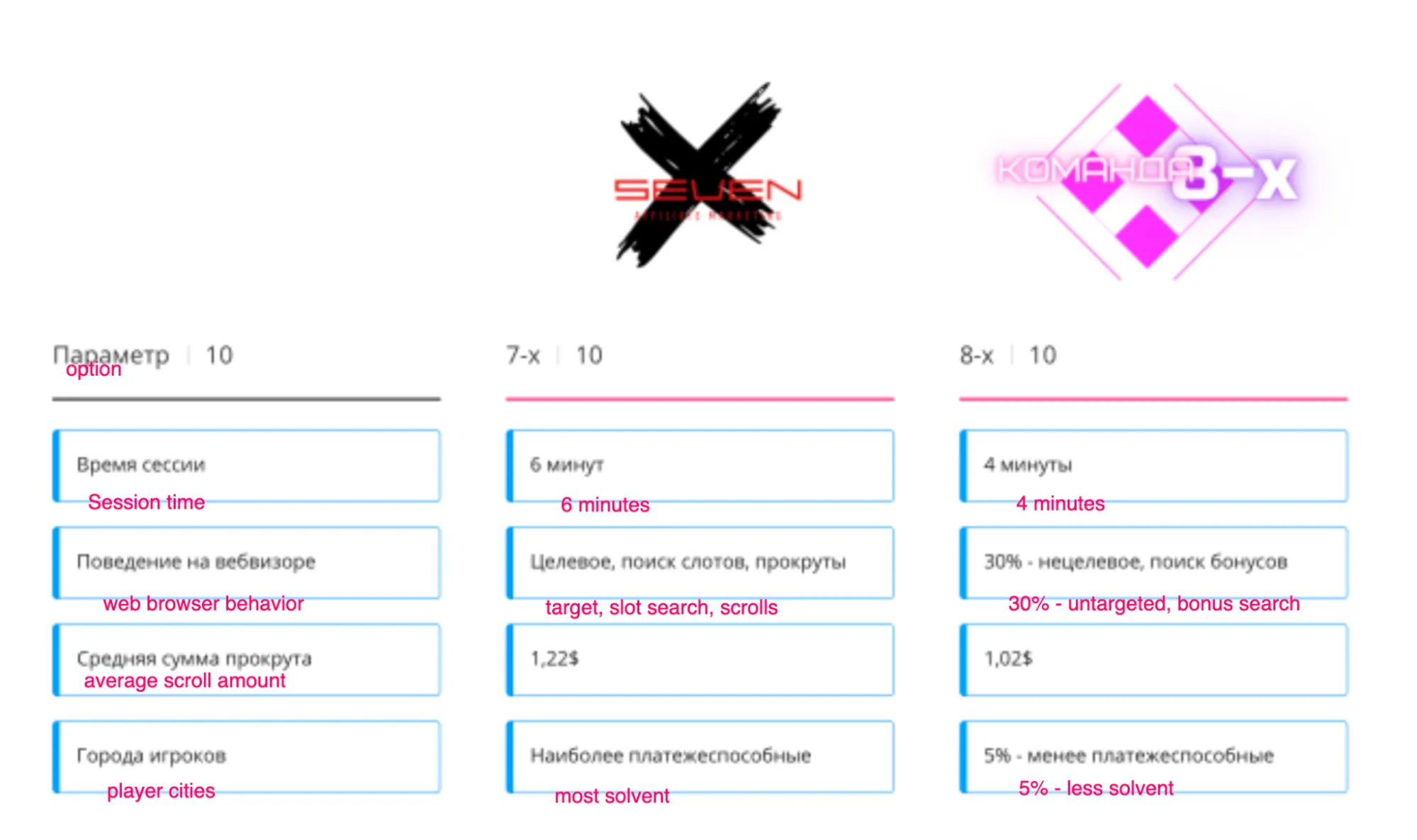

The additional tool that we usually apply is studying player behavior. Right now, we can analyze:

- Average session duration;

- Scroll sum step;

- Frequency of site visits.

It's important to understand that at this stage, it's challenging to determine with 100% certainty which traffic will ultimately pay off and which won't. Both may prove profitable, or neither may. After all, anything can happen – the technical manager of the team might accidentally disable links, and the traffic could die out – stuff happens.

Assuming that both partners are unknown to us, looking at the table comparing the initial metrics, we’d make the decision to continue working with the team 8-x. Although the initial amounts here are lower than those of the 7-x team, the traffic is more targeted, and the majority of changes in the deposit amount by target players are related to passing the baseline. Over time, some players from the low-deposit category will transition to the qualified category, so we continue purchasing this traffic.

As for the team 7-x, we’d firstly give them recommendations regarding the presence of non-targeted players by geo – this means that there might be something wrong with the targeting. This can actually affect the targeted players and their engagement. For instance, if we're attracting people from Europe who are using a Swiss VPN, that's not very good. Even though this scenario is unrealistic, we present it so that everyone understands.

Everyone has different metrics, and the understanding of traffic quality varies, but generally, we all consider similar, if not identical, factors. Moving on to the situation in the second week.

What does the advertiser look at when there's been traffic only for 2 weeks?!

In the first part, we discussed the parameters we familiarize ourselves with first. Today, let's expand this list a bit. Let's see how the traffic has changed over another week, breaking it down by teams.

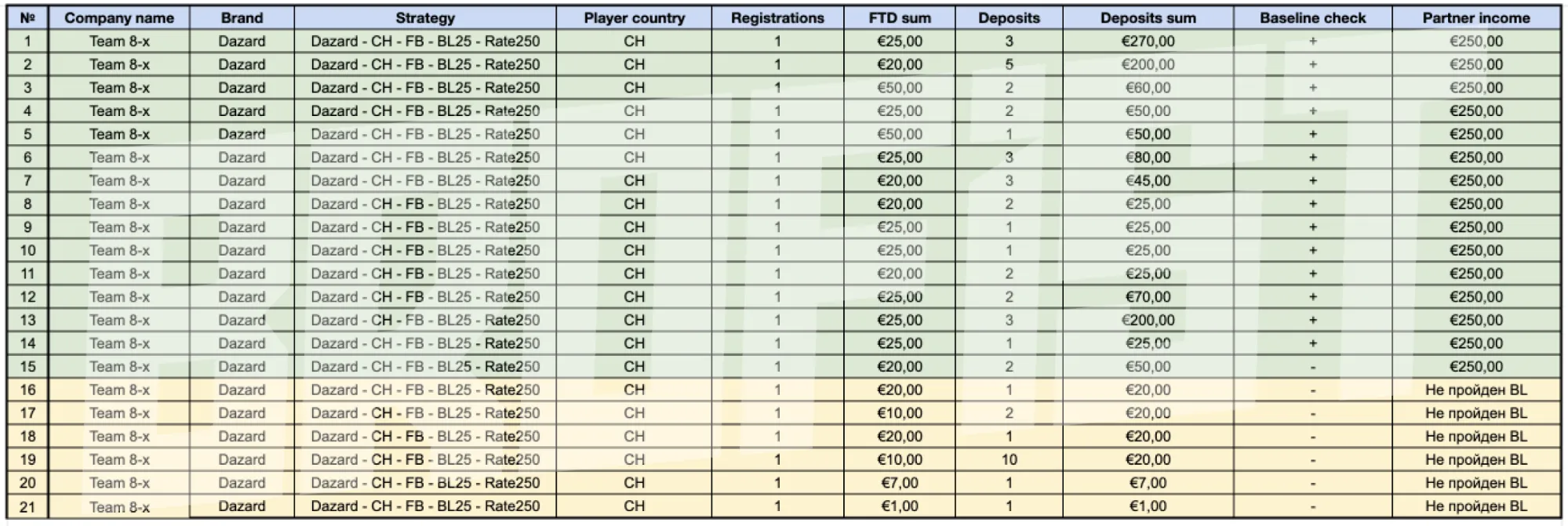

Traffic data from the 7-x team, where the traffic payback reached 58.38% compared to 27% last week:

Despite some of the traffic coming from non-targeted GEOs, we've noticed a positive dynamic in deposit amounts and activity. Even now, we see that players from Denmark have made deposits higher than what we pay for Switzerland. Therefore, it would be fair to consider these deposits for payouts.

What has changed?

- Deposit amounts have almost doubled, which is quite interesting for the 2nd week;

- Some players have managed to break through the baseline compared to last week;

- The number of players with only minimum deposits has decreased to an acceptable level (no more than 20%).

8-x team:

What has changed?

- The deposit amount has increased;

- Some players have made repeat deposits;

- Another player has broken through the baseline.

What do we see? Despite giving both partners an overcap last week, traffic profitability is evolving differently. And this is considering that they have identical acquisition methods. The traffic that seemed more interesting to us in the first week is now less attractive—the numbers speak for themselves.

What could be the reasons for this?

- Using non-targeted targeting;

- Using the wrong interests;

- Underutilization or non-utilization of push notifications in apps, or vice versa, their overuse — when there’re too many, it discourages players from engaging and playing;

- Using old, worn-out creatives;

- Using misleading texts and creatives;

- Technical error when working with apps. For example, incorrect stream translations, failure to set stream memory, and now every player rotates the same roulette upon reauthorization.

What else do we pay attention to? Session duration, average scroll amount, and the cities from which players are accessing.

What conclusions do we draw?

Despite the differences in player behavior and amounts - which is most important to us - we need to work with partners on their traffic uploads: give advice, show numbers. We always strive to guide webmasters in the right direction because, as advertisers, we need to continue working with their traffic, and you need to direct it elsewhere. This immediately reduces expenses for both us in the short term and the team in the long run.

Moreover, when the advertiser does such work with partners, the mutual commitment becomes much stronger, which should be in the interests of both parties.

In conclusion, we think the following:

- The second team may seem worse compared to the first, but in reality, we’re considering a scenario where the first team simply has a different approach. Both teams' traffic is considered good for us within the 2nd week;

- We provide the first team with numbers and advice to make their traffic even better;

- We provide the second team with numbers and advice to improve their traffic in the future (since we've already given them caps);

- Session duration is roughly the same for both teams, making both of their traffics interesting. We’ll continue to buy it within the allocated budget - only 40 FTDs for each partner;

- The average scroll amount for both teams looks interesting, so we can work with them;

- The second team needs to work on technical aspects. Perhaps something is preventing players from being more active.

by Editor

comments ....(0)

Leave a comment

You must be in to leave a comment